A team of international analysts

Credit risk management is undoubtedly among the most crucial issues in the field of financial risk management. With the recent financial turmoil and the regulatory changes introduced by Basel III, credit risk analysis and risk assessment in general have been receiving even greater attention by the Corporate and banking industry.

The ability to discriminate good customers from bad ones is a highly decisive element to be a successful player in the banking and credit industry. Predicting and mitigating default events is at the core of appropriate credit risk management and this can be greatly helped by employing suitable quantitative models, without however precluding the reliance on human expert judgment.

International financial analyzes are often interpreted differently. At FINBRAIN-ITC we are at your disposal to help you analyze your information. You will have a permanent partner, specializing in international business information.

We have a wide experience acting as credit managers a.i. in a multi-sectoral environment.

Current financing difficulties for SMEs Small- and medium-sized enterprises (SMEs1) play a significant role in their economies as key generators of employment and income, and as drivers of innovation and growth. SMEs employ more than half of the private sector labour force in OECD economies. Given their importance in all economies, they are essential for the economic recovery from the current economic and financial crisis.

The crisis has had a negative effect on bank lending. When bank lending is reduced, SMEs tend to be more vulnerable and affected than larger corporations and credit sources tend to dry up more rapidly for small firms than for large companies during economic downturns.

Specifically, we will help you to:

- Apply a structured approach to assess the creditworthiness of a borrower;

- Evaluate the performance of a company based on qualitative and quantitative frameworks and tools;

- Use appropriate market indicators, where available to understand refinancing risk and the market view on a credit;

- Identify the key factors that drive a company’s future performance and evaluate the likely impact on its credit standing;

- Use a cash flow approach to ascertain a company’s ability to service/refinance its debt as it comes due;

- Review debt structures to assess to what extent they meet the commercial needs of the borrower and protect the lender’s interests.

The European Union provides a clear assistance. BEI_presentation_n._3 (SMEs). This is available in different forms such as grants, loans and, in some cases, guarantees. Support is available either directly or through programmes managed at national or regional level, such as presented in the next EIBs presentation. BEI_presentation_n._4

SMEs can also benefit from a series of non-financial assistance measures in the form of programmes and business support services. We will be pleased to explain.

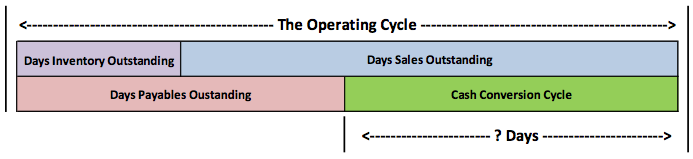

Cash conversion cycle

The Cash conversion cycle (CCC) measures how long a firm will be deprived of cash if it increases its investment in resources in order to expand customer sales. It is thus a measure of the liquidity risk entailed by growth.

The (DIO) Days Inventory outstanding gives an indication of the average period for which you have your merchandises in stock.

The (DPO) Days Payable outstanding gives an indication of the average period in which you pay your suppliers

The (DSO) Days Sales outstanding gives an indication of the efficiency of your credit management

The Cash Conversion Cycle (CCC) is calculated as follows: DIO + DSO – DPO = CCC

In other terms, we add the number of days that a customer takes for making his payment to the number of days you have kept the product in stock. This amount will be reduced by the number of days you have taken on the supplier credit conditions. The number of days obtained is the period during which you will have to provide funding.