Our commitment to delivering high-quality treasury services which is at the heart of what we do. Treasury management is the administration of a company’s cash flow as well as the creation and governance of policies and procedures that ensure the company manages risk successfully.The treasury function is changing, raising some pressing questions about companies’ organisational structure, treasury reporting and systems, oversight and control.

Today, we see the corporate treasury profession maturing and consolidating its role as the custodian of financial and liquidity risk management. Best practice has found its way into the policies, procedures and systems being reviewed by most corporate treasury departments, and there’s a strong consensus around strategy, development, execution and reporting.

Our team can help you face these challenges and find the most value in your treasury management. Whether dealing with general treasury governance, cash visibility, TMS implementation, Saas approach, transfer pricing (including BEPS), managing commodity risk, set-up of your cash-pool, reducing debt levels, or reducing P&L volatility, cost reductions, FINBRAIN-ITC is ready to help. We can work with you at every stage of your treasury project, from assessment and design through to implementation and beyond.

Our extensive experience in this area allows our customers to re-engineer their business processes and select the appropriate systems for the complexity of their requirements. We have helped to deliver solutions to ensure sound treasury strategy where cash management, payments and risk management are all achieved.

How can we help?

Our services are designed to help Treasury Managers in their efforts to:

- Optimise profits by making the most of your cash flows

- Benefit from a stable partner to manage your payments and collections,

- Invest your surpluses or make up for shortfalls;

- Manage corporate funding by optimizing the funding and refinancing structures;

- We can offer you efficient and creative solutions and ensure that your transactions always run smoothly.

- Manage financial risk by designing and implementing risk measurement models and valuation of financial instruments;

- Manage derivatives and investment operations by optimizing and monitoring corporate hedging strategies;

- Optimize treasury management by assessing and benchmarking treasury management, organizations and processes and designing and implementing best in class solutions like cash-pools, treasury policies, or cash flow forecasting models;

You need also to consider

- Ensure Straight Through Processing (STP) with a Financial Gateway;

- Increase efficiency by performing cash management from a centralized location;

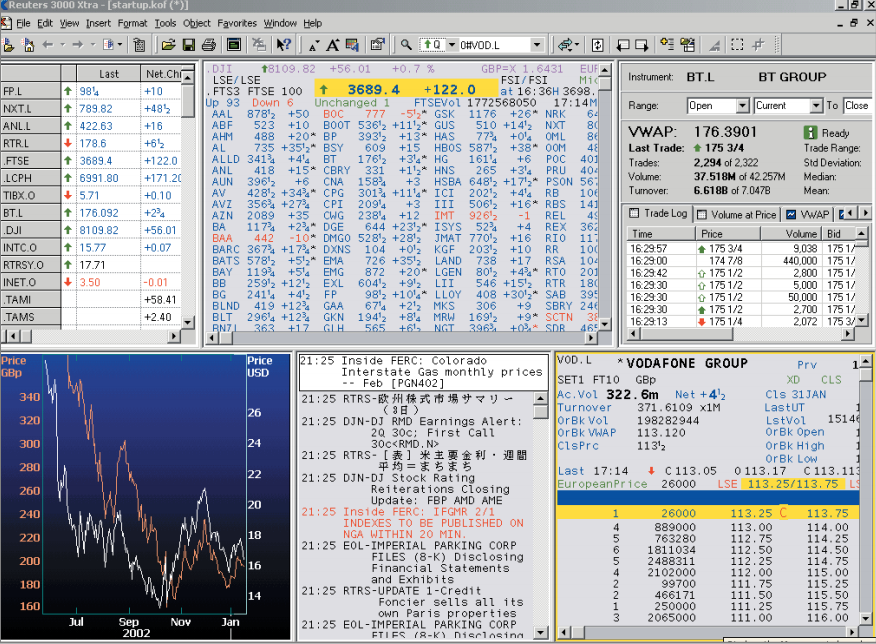

- Facilitate seamless communication between banks, financial institutions, and corporations and services providers (Reuters or Bloomberg)

- Gain visibility into real-time cash positioning;

- Increase productivity with centralized processing and electronic banking

- Predict cash requirements and maximize returns

- Ensure adequate control and accounting of cash management processes

- Improve bottom line by accurately forecasting short and medium-term cash requirements • Empower cash positions throughout the day

- Drive performance through tight integration with a well structured TMS

- Improve return on investment by combining idle cash to make short-term investments

- Reduce manual entry errors by automatically downloading bank statements (Coda and MT940)

A treasury management system (TMS) won’t be effective if it isn’t implemented correctly. Learn how to do it the right way to avoid problems down the road.

It’s relatively easy for treasury departments to manage a few bank accounts, but once a company has multiple banking relationships in multiple currencies with multiple risk factors spread around the globe, the job becomes quite a bit more complicated. That’s why, more and more, organizations are implementing treasury management systems to help rein in the variety of complex treasury functions.

Why are treasury management systems important?

Treasury focuses on the biggest asset of a company: cash!

The need for a treasury system really comes from the fact that you have great complexity in functionality and an increasingly important role to play within the organization. Treasuries are able to automate core treasury operations like cash management, foreign exchange, risk management, currency positioning and compliance with specialty applications such as SunGard, Reval, Wall Street Systems, Kyriba or with modules offered by their current enterprise resource planning systems like SAP or Oracle.

The goal of this TMS is to have the ability to see the whole financial picture of a company in one place, but also to have a robust analytical capability. You have a large amount of data that needs an interface that allows you to understand it easily and to dig into it to get answers.

When a treasury department decides it can no longer successfully function by piecing together a complex array of spreadsheets and has done the hard work of choosing the right treasury management system vendor, then the critical task of a successful implementation can begin. We will assist you in writing your Request for Proposal (RFP) and to implement your system and the complementary interfaces.